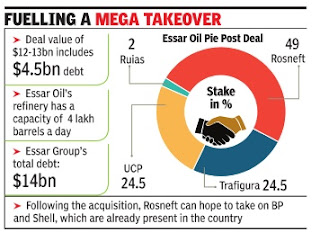

Rosneft, others to buy 98% of Essar Oil in $13bn deal

Transaction

Will Help Ruias Reduce Group's Debt Burden

In one of

the biggest acquisitions by overseas investors in India, the world's largest

publicly traded oil company Rosneft, along with commodities trader Trafigura

and Russian fund UCP , is set to acquire a 98% stake in Essar Oil for $12-13

billion (over Rs 80,000 crore).

The

transaction involves a takeover of Essar Oil's debt of around $4.5 billion

(over Rs 30,000 crore). While the Russian oil giant will hold a 49% stake,

Trafigura and UCP will equally split another 49%, leaving 2% with the promoters

-the Ruia family , sources familiar with the deal said. The transaction will be

formally announced on Saturday on the sidelines of the Brics summit.

The deal

puts a seal to India's growing energy ties with Russia and comes at a time when

there is a major push to attract overseas investment.Recently, state-run Indian

oil companies completed deals worth close to $5 billion in Ros neft's

exploration ventures.

Following

the acquisition, Rosneft will have a large footprint in India and can hope to

take on BP and Shell which are already in the country . In 2011, BP had paid

$7.2 billion for a 30% interest in RIL's exploration portfolio, which was the

largest ever deal in the oil sector. The government has repeatedly tried to get

Saudi Aramco to invest in the country .

The

transaction will help Ruias reduce the group's debt burden and focus on Essar

Steel, which is also facing financial strain due to the large volume of loan on

its books. In recent months, production has been ramped up at the steel company

.

A news

agency said the deal will be funded by Russia's VTB Capital, part of

statecontrolled bank VTB. The VTB Group is under Western sanctions over

Russia's role in the Ukraine crisis, which restrict its access to international

capital. The deal will include the Vadinar refinery and an associated port. The

refining capacity is estimated at 400,000 barrel-per-day and sells fuels

through its 2,470 pumps. It is not clear if the pumps are part of the

transaction. Oil & Natural Gas Corp, the largest Indian oil and gas

explorer, and Hong Kong-listed United Energy Group are among bidders for

Bangladesh natural gas assets being sold by Chevron Corp, people with knowledge

of the matter said.

United

Energy submitted a joint offer with Chinese conglomerate Orient Group, one of

the people said. The gas fields, which could fetch as much as $2 billion, have

also drawn interest from Brightoil Petroleum Holdings, the people said, asking

not to be identified because the information is private.

The

Bangladeshi government has also expressed interest in taking over Chevron's

interests in the assets, according to the people. No final agreement has been

reached with any party , the people said.

Energy

companies have announced $43.2 billion of asset sales this year after crude

prices fell to the lowest level in more than a decade, according to data

compiled by Bloomberg. Chevron, the largest US oil producer after Exxon Mobil

Corp, is seeking buyers for Asian geothermal assets that could fetch as much as

$3 billion and is also holding talks to sell assets in Indonesia and Thailand,

people familiar with the matter said earlier.

The San

Ramon, California-based company operates the Bibiyana, Jalalabad and Moulavi

Bazar natural gas fields in Bangladesh and sells all the production to state

oil company Petrobangla, according to its website. Its net daily production

last year averaged 720 million cubic feet of natural gas and 3,000 barrels of

condensate.

“We can

confirm that Chevron has been in commercial discussions about our interests in

Bangladesh,“ Chevron said in an e-mailed statement Thursday .“At this stage, no

decision has been made to sell our interests. We will only proceed if we can

realize attractive value for Chevron.“

Representatives

for ONGC, United Energy , Brightoil Petroleum, the Bangladeshi energy ministry

and Petrobangla didn't immediately respond to requests for comment. Calls to

Orient Group's general line were unanswered. United Energy agreed to buy BP's

exploration and production assets in Pakistan for $775 million in 2010, its

first venture in the country.

No comments:

Post a Comment